is colorado a community property state for tax purposes

Welcome to the Division of Property Taxations Personal Property website. Community Property States vs.

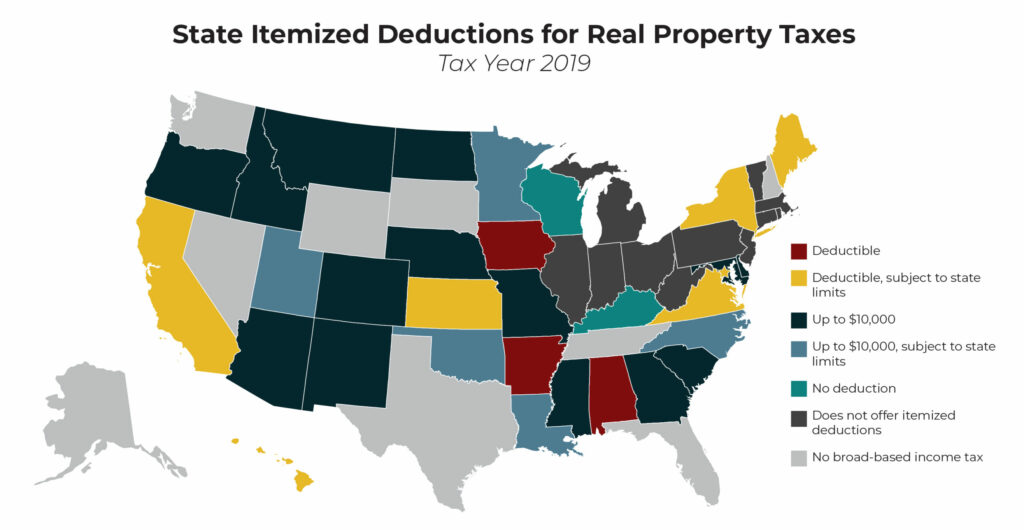

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

January 5 2021.

. On November 5 2021 the Colorado Department of Revenue Division of Taxation announced that it is convening a stakeholder workgroup. An entertaining MSN Money article today discusses Tom Cruises little known farming career and Colorados method of handing out property tax breaks for land designated as agricultural. These states are Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

The courts ability to divide marital property if a couple divorces does not impact a spouses ability to give away his share of. The Assessors Office is required to appraise all real property and to estimate the value for ad valorem taxation purposes. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own.

Tax Benefits of Holding Title as Community Property. Colorado is an equitable distribution or common law state rather than a community property state. Is Colorado A Community Property State For Tax Purposes The qualified investment in used property is limited to 150000 per year and any amounts expensed under section 179 of The llc is wholly owned by the husband and wife.

A community property state is one in which the assets of a married couple are considered to be owned jointly even if only one spouse holds a title to a particular asset or piece of property. This site is designed to help taxpayers and other interested parties understand the basics of personal property assessment in Colorado including basic filing requirements valuation information protest procedures etc. Many couples want to hold title as community property for tax purposes.

Colorado is an equitable distribution or common law state rather than a community property state. Other community property states recognize these forms of ownership and will treat the asset as separate property of the spouses held in joint tenancy. That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce.

The reason has to do with a tax concept known as basisYou can think of basis as the amount you can recover tax-free on the sale of a property. The deadline to file a 2022 Exempt Property Report is April 15 2022. Colorado is not a community property state as courts do not assume that the property obtained during the course of a marriage is all marital property.

The State of Colorado distinguishes between property and property belonging to the conjugal estate both spouses and separated property belonging to one of the spouses. Of Local Affairs 2013 Annual Report. That is while a couple is married creditors of one spouse with certain restrictions can seize the assets of both spouses.

Certification of Levies and Revenues by County. Pursuant to Colorado State General Property Tax Law the duty of the Assessor is to discover list and value all real property. Generally the laws of the state in which you are domiciled govern whether you have community property and community income or separate property and separate income for federal tax purposes.

If they move to Arizona and take up Arizona residency Rev. The size of the personal property tax base is presented both by class statewide and by county. Colorado does not currently impose a property tax for state purposes see Colorado Dept.

Business Personal Property Tax Background Information This section of the memorandum1 describes business personal property tax filing and assessment procedures the types of equipment subject to the tax and the personal property tax base. A summary of each of the community property states treatment of property purportedly titled in joint tenancy or tenancy in common is shown in Exhibit 25181-1. Colorado is not a community property state in a divorce.

Generally the laws of the state in which you are domiciled govern whether you have community property and community income or separate property and separate income for federal tax purposes. Stakeholder Workgroup Meeting Colorado Net Operating Losses. The sale of property jointly owned by a husband and wife for example.

These laws have a significant impact on their tax situations. According to the IRS. Colorado is also a dual-property state which means property can be defined as either marital or.

Nine states have community property laws that govern how married couples share ownership of their incomes and property. Couples filing separately in community property states must follow their states rules when allocating property on their respective returns. However what is considered community property varies by state and no two community property states follow the same set of rules.

The Denver Post lists the wide array of so-called Colorado agronomists who have secured low property taxes through agricultural designations on land they own even though. 79-124 suggests they could contribute the Colorado rental property to an Arizona LLC taxed as a partnership gift a small interest to their children in order for the LLC to be a partnership for federal tax purposes and their LLC interest would be community property under Arizona law. This exception will not apply to joint ownerships of property which are not recognized as partnerships for federal income tax purposes.

The following is a summary of the general rules. The rules vary greatly on this. Colorado is not a community property state but it does have a category called marital property In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

Income tax purposes and required to file annual federal partnership returns of income will not be subject to the Colorado withholding tax. Instead when a couple divorces in Colorado the marital property is divided in an equitable manner. Colorado is not a community property state.

Forms are mailed by March 1. If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and provide your file number see previous years form and updated mailing address. Page 4 of IRS Publication 555 provides a general overview.

Tax Increment Financing Video Library The Division of Property Taxation coordinates and administers the implementation of property tax law throughout the state and operates under the leadership of the property tax administrator who is appointed by. In community property states the assets of each spouse are considered assets of the marital unitThe assets of each partner in the relationship are not legally separate from those of the spouse. Generally when an asset or debt is acquired after marriage it is generally considered part of the marital estate under section 14-10-1132 of the revised Colorado Act.

Infographic Tax Day Income Tax State Tax Budgeting Money

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Community Property States List Vs Common Law Taxes Definition

How Do State And Local Sales Taxes Work Tax Policy Center

Property Tax Delinquency Varies Across States Corelogic

Community Property States List Vs Common Law Taxes Definition

Community Property States List Vs Common Law Taxes Definition

Thinking About Moving These States Have The Lowest Property Taxes

Is Colorado A Community Property State Johnson Law Group

Tax Implication Of Owning Property In Another State In 2022

States Without Sales Tax Article

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

States With Highest And Lowest Sales Tax Rates

States With The Highest And Lowest Property Taxes Property Tax States High Low

Children Under The Age Of 18 Can Earn Income From Jobs Chores And Even Investment Opportunities Whether It S Gifted Property Or Irs Taxes Tax Debt Tax Help

Five Tax Tips For Community Property States Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)